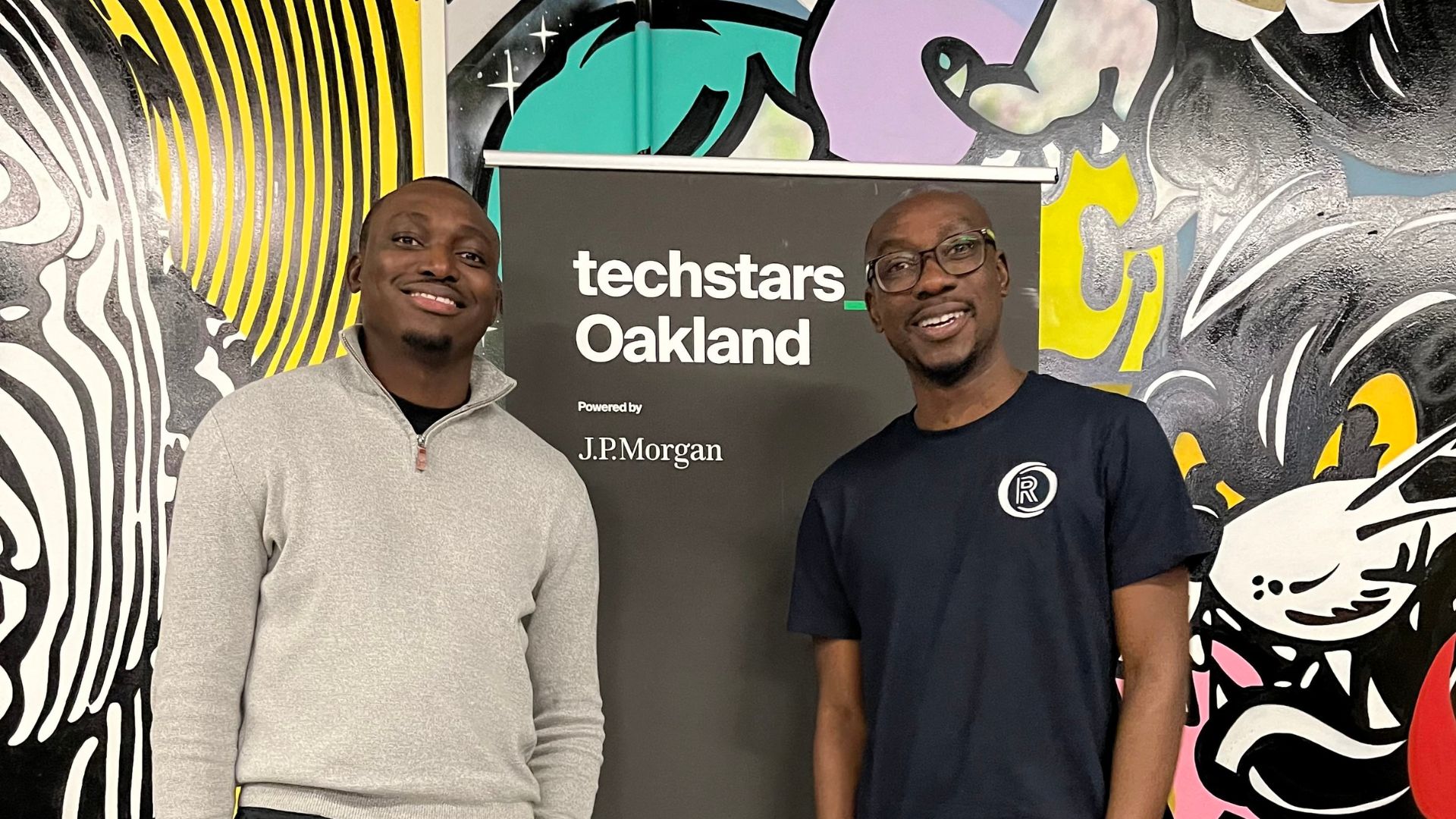

AML compliance startup, Regfyl, raises $1.1 million

We bring exciting news for Africa’s fintech landscape!

Regfyl, an anti-money laundering (AML) compliance startup from Nigeria, has just secured a whooping $1.1 million in pre-seed funding.

They will use this funding to tackle the pressing regulatory challenges faced by our financial institutions.

With investment from industry leaders like Techstars, RallyCap Ventures, and Africa Fintech Collective, Regfyl is big on her mission to simplify AML compliance for African fintechs and banks.

African financial institutions are caught between rapidly evolving regulations and the need for efficient operations. We’re building a bridge to help them navigate this complex landscape.

Tunde Ibidapo-Obe, CEO of Regfyl

Did you know that 60% of the countries on the FATF ‘grey list’ are in Africa?

(By the way, FATF means Financial Action Task Force)

In Nigeria alone, over 90% of fintechs still struggle with AML requirements!

Regfyl’s platform makes compliance easier by checking everything in one go, which could lower costs by up to 40%.

What sets Regfyl apart? Their AI-powered transaction monitoring system is tailored specifically for Africa’s unique financial ecosystem.

“We’re not just applying Western models to African problems,” says co-founder Tomiwa Erinosho.

Their AI is trained on regional data to detect and prevent fraud.

This funding will enable them to expand their business development, engineering, and customer success teams.

We are happy about this step towards a more compliant and secure financial future for Africa! 🎉

Congratulations to the entire team Regfyl