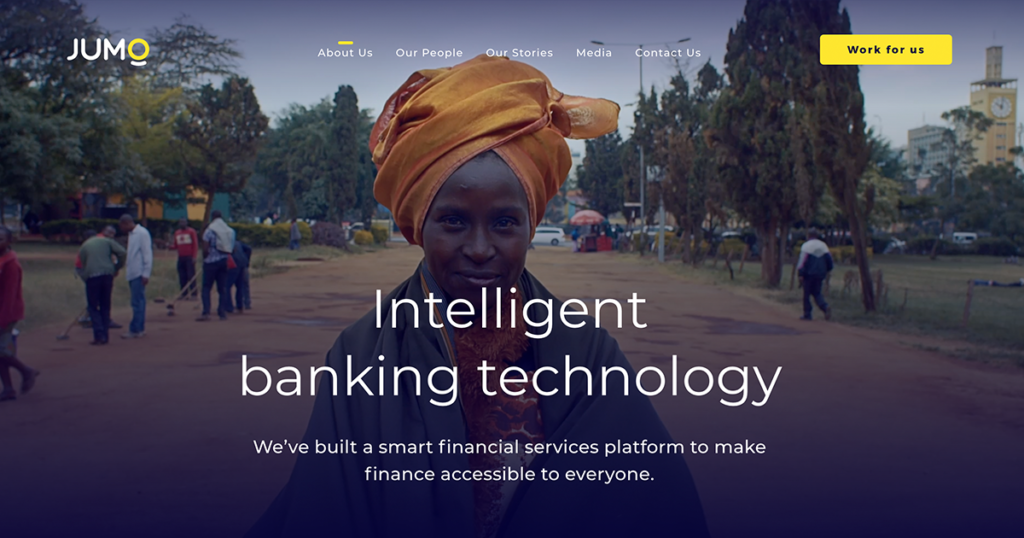

JUMO, Changing FinTech As We Know It

Founded in 2015, JUMO is a platform for banking as a service, leveraging artificial intelligence to power financial services in developing economies.

🤔What makes JUMO special?

JUMO offers individuals who do not have access to financial services the ability to access finance anonymously through a mobile app, giving underserved individuals more opportunities to elevate their status.

The South African fintech company provides financial services infrastructure to partners like banks, mobile fintech platforms, and eMoney operators, in addition to savings and investment products for business owners in emerging economies.

💪The organization primarily serves microentrepreneurs, offering a dependable and affordable substitute for nearby unregulated lenders. This indirectly creates jobs, leading to an increase in revenues from local taxes.

There are two fundamental features of the platform: 👉Core which offers next-generation, end-to-end financial infrastructure, and the artificial intelligence processor; AND

👉Unify which analyzes data to lower loan costs and risks.

By employing these features, JUMO has facilitated the distribution of loans and has touched many clients and small enterprises in just about nine years of operation. They operate in seven markets: South Africa, Tanzania, Kenya, Uganda, Zambia, Ghana, and Côte d’Ivoire.

Jumo is bringing accessible financial solutions to marginalized populations, enhancing lives, and opening doors to economic possibilities throughout Africa and beyond.

Did you know about Jumo? Look out! They might be coming to your country soon✨